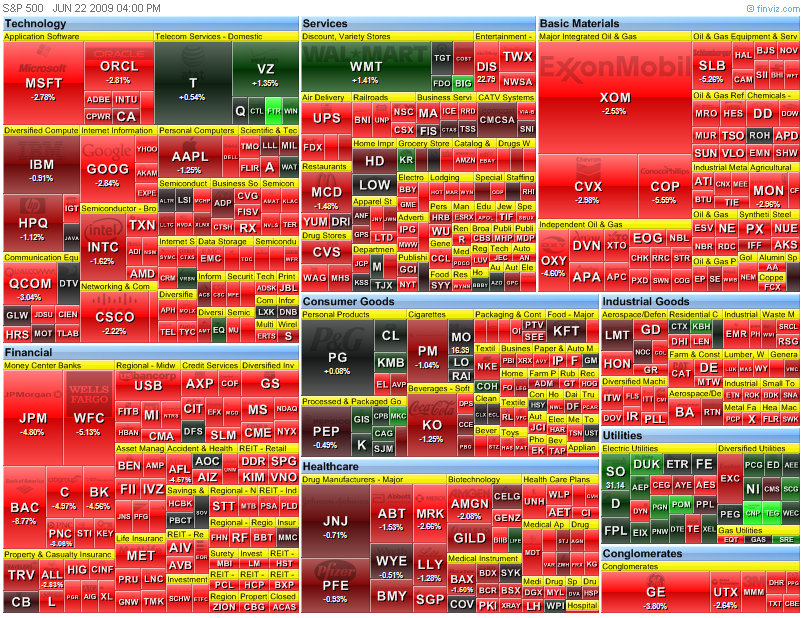

The financials win AGAIN! Shocked, just shocked I tell ya'.

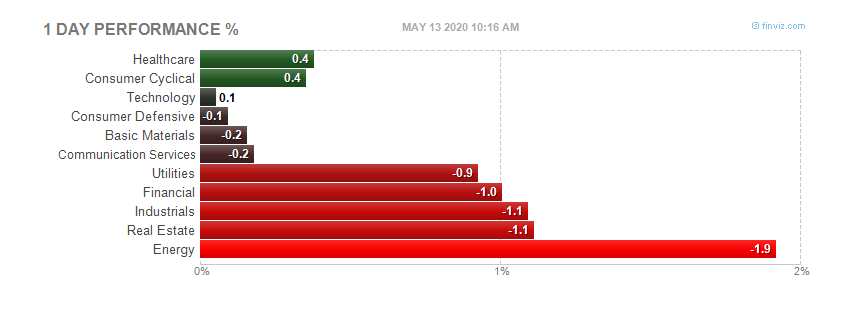

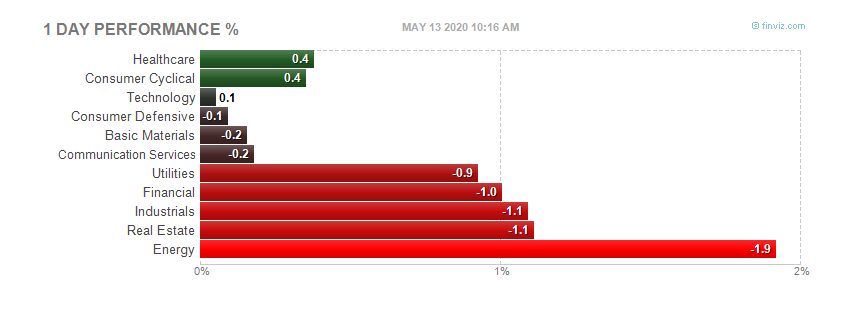

Today's heatmap:

The financials win AGAIN! Shocked, just shocked I tell ya'.

Today's heatmap:

I'm going out on a limb here, and make a prediction. Next Tuesday is the last day of the quarter/half. This is also the date where many people retirement deadline is set. That meaning, they have until Tuesday (or a day before)to enter their choices for how they want to invest. Many plans I know of let you change your risk and plans on a quarterly or bi-annually. Next Tuesday is the date. What happens then? The guess of this blogger is the market will go down. How far and how fast, I don't know, but the general direction is down. How low? Not sure, we have two things that are in a fistfight - the truth, and the government. The truth of the matter is, the economy, not only here, but all over the world, is not good at all. Despite the slight up ticks (or the second derivative - rate of change), the reports we see (and you can read them, many I post here)are not very good. You must remember the people on CNBC only give us the headline numbers. You must dig into the reports, sometimes not too far, to find the real truth. Housing, retail,GDP,what some consider to be the next big shoe to drip, Commerical Real Estate (CRE), and above all JOBS - are not good. That is the truth part of the equation. On the other side you have the government and the banks. Who will get saved and who will get screwed. Fundamentals don't matter any more, and probably haven't for quite some time. This is a casino - cash is a position - and rationality has left the building. The road to economic prosperity and will be driven by I-phones, coffee, and some other stocks that make no sense. Bernanke is in front of congress having an "I can't recall" recital, while the administration might be happy to put Larry Summers in his place. Either way, the FED chair will be the most powerful force in how the dollar, bond curves, and securities will fare. It will be an interesting and probably entertaining next few quarters. Safe trading.