Full report here

UNEMPLOYMENT INSURANCE WEEKLY CLAIMS REPORT

SEASONALLY ADJUSTED DATA

In the week ending Sept. 19, the advance figure for seasonally adjusted initial claims was 530,000, a decrease of 21,000 from the previous week's revised figure of 551,000. The 4-week moving average was 553,500, a decrease of 11,000 from the previous week's revised average of 564,500.

The advance seasonally adjusted insured unemployment rate was 4.6 percent for the week ending Sept. 12, a decrease of 0.1 percentage point from the prior week's unrevised rate of 4.7 percent.

The advance number for seasonally adjusted insured unemployment during the week ending Sept. 12 was 6,138,000, a decrease of 123,000 from the preceding week's revised level of 6,261,000. The 4-week moving average was 6,187,250, a decrease of 1,250 from the preceding week's revised average of 6,188,500.

The fiscal year-to-date average for seasonally adjusted insured unemployment for all programs is 5.651 million.

UNADJUSTED DATA

The advance number of actual initial claims under state programs, unadjusted, totaled 434,358 in the week ending Sept. 19, an increase of 21,966 from the previous week. There were 398,070 initial claims in the comparable week in 2008.

The advance unadjusted insured unemployment rate was 3.9 percent during the week ending Sept. 12, a decrease of 0.1 percentage point from the prior week. The advance unadjusted number for persons claiming UI benefits in state programs totaled 5,204,972, a decrease of 91,789 from the preceding week. A year earlier, the rate was 2.3 percent and the volume was 3,014,874.

Extended benefits were available in Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, the District of Columbia, Florida, Georgia, Idaho, Illinois, Indiana, Kansas, Kentucky, Maine, Massachusetts, Michigan, Minnesota, Missouri, Nevada, New Hampshire, New Jersey, New York, North Carolina, Ohio, Oregon, Pennsylvania, Puerto Rico, Rhode Island, South Carolina, Tennessee, Texas, Vermont, Virginia, Washington, West Virginia, and Wisconsin during the week ending Sept. 5.

Initial claims for UI benefits by former Federal civilian employees totaled 1,141 in the week ending Sept. 12, a decrease of 401 from the prior week. There were 1,919 initial claims by newly discharged veterans, a decrease of 281 from the preceding week.

There were 19,192 former Federal civilian employees claiming UI benefits for the week ending Sept. 5, a decrease of 1,233 from the previous week. Newly discharged veterans claiming benefits totaled 30,213, a decrease of 51 from the prior week.

States reported 3,223,849 persons claiming EUC (Emergency Unemployment Compensation) benefits for the week ending Sept. 5, an increase of 82,364 from the prior week. There were 1,116,863 claimants in the comparable week in 2008. EUC weekly claims include both first and second tier activity.

The highest insured unemployment rates in the week ending Sept. 5 were in Puerto Rico (6.7 percent), Oregon (5.6), Nevada (5.4), Pennsylvania (5.4), Michigan (5.2), Wisconsin (4.9), California (4.8), New Jersey (4.8), Connecticut (4.7), North Carolina (4.7), and South Carolina (4.7).

The largest increases in initial claims for the week ending Sept. 12 were in Wisconsin (+1,573), Oregon (+829), and Kansas(+677), while the largest decreases were in Texas (-4,623), Illinois (-4,217), Pennsylvania (-3,961), Michigan (-3,012), and Massachusetts (-2,389).

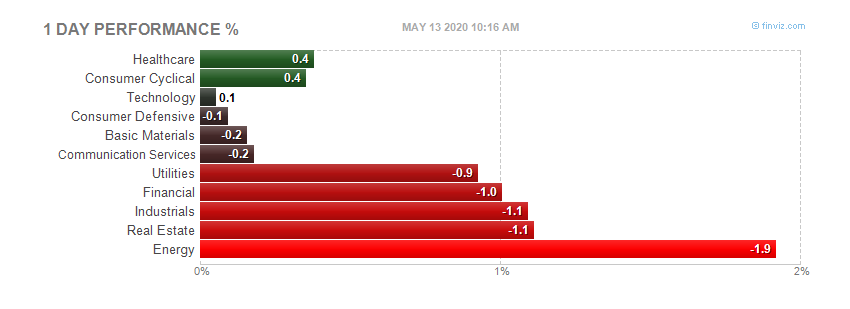

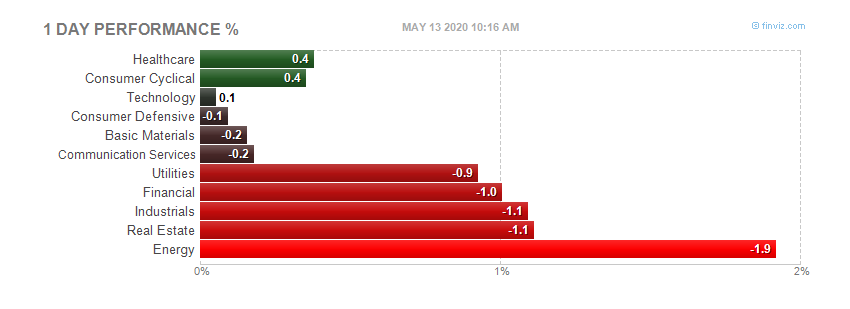

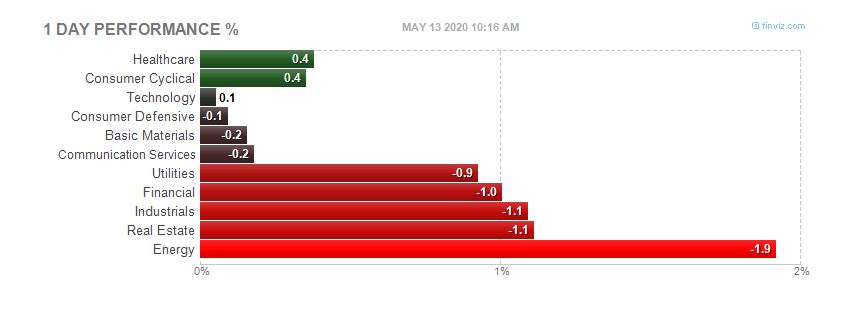

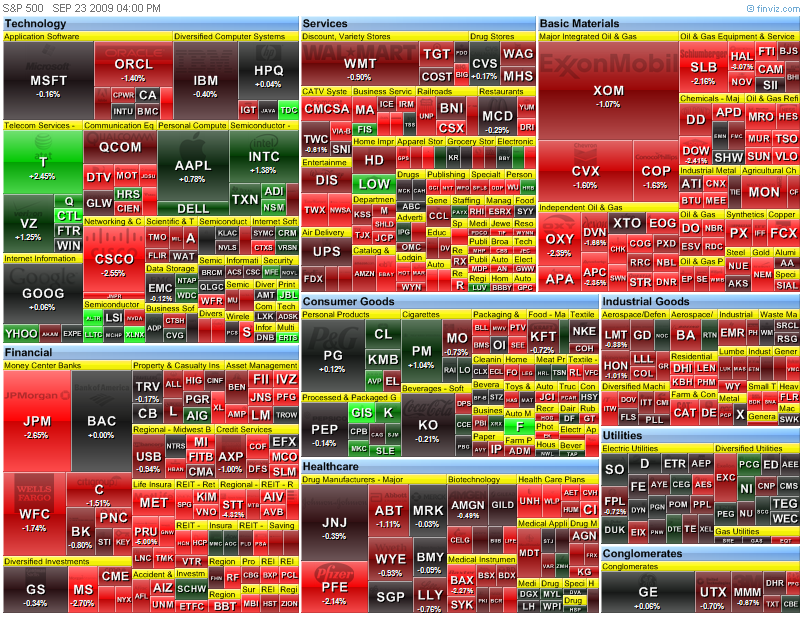

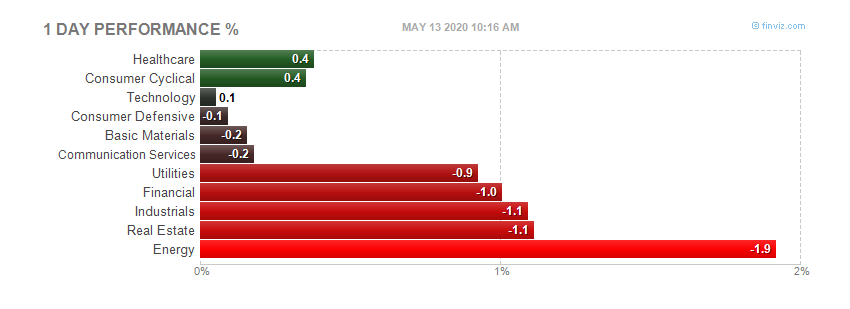

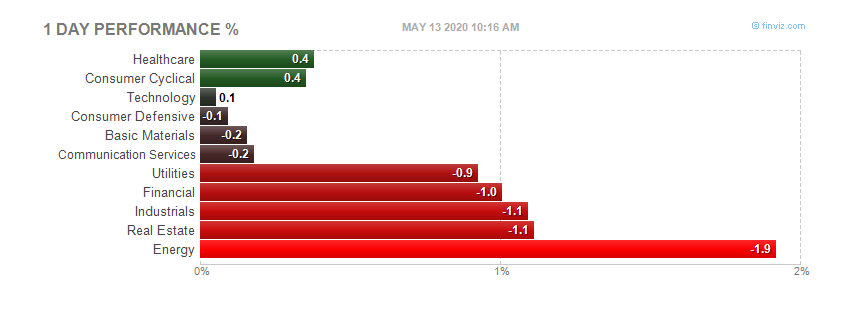

Today's heatmap:

Today's heatmap:

Today's heatmap:

Today's heatmap:

Today's heatmap:

Today's heatmap:

Of note:

RIMM missed earnings, down 10 percent after hours.

MCD upping dividend 10 percent.

Of note:

RIMM missed earnings, down 10 percent after hours.

MCD upping dividend 10 percent.

Today's heatmap

Today's heatmap

Today's heatmap:

Today's heatmap:

Today's heatmap:

Today's heatmap: